What’s Really Happening in Pipes, MDF, and Tile Stocks?

#Issue 25 Behind the glossy valuations of pipes, MDF, and tile firms lies a structural problem of slowing growth, rising supply, and fierce competition. A deep dive into what the market is missing.

📌 TL;DR (Too Long; Didn’t Read)

Pipes: Demand is slowing, capacity is rising, resin prices under pressure, margins at risk.

MDF: Bottoming out on margins; demand growth intact, supply expansion slowing. Better positioned medium term.

Tiles: Demand stagnant, unorganized Morbi market driving brutal pricing. Cost-cutting is short-term relief.

Valuations remain unjustified relative to actual earnings and profitability growth trends.

🧱 Part 1: Non-Metal Pipes: Once a Market Darling, Now a Margin Worry

The PVC/CPVC pipe segment, once the poster child of India’s infrastructure and housing-led growth story, is showing signs of long-term saturation. While companies rode a wave of price hikes, import dependence, and a growing housing stock over the last decade, the tide may be turning.

PVC vs CPVC vs OPVC – Full Comparison Table

PVC:

Best for low-cost, low-pressure applications – agriculture, conduits, drainage.CPVC:

Ideal for hot & cold plumbing, chemical transport – widely used in residential and industrial buildings.OPVC:

Designed for large-scale water infrastructure – municipal water supply, smart cities, Jal Jeevan Mission.

Offers highest pressure capacity, weight savings, and long-term durability – future-ready, but early-stage in India.

🔹 Demand: Slowing Across the Board

The street perception of consistent double-digit volume growth is being challenged by ground realities:

PVC Pipes:

Assumed to grow at 10–12% historically.

Actual: ~6% volume CAGR over last 10 years.

Price growth just 1% CAGR → Value CAGR = ~6%

CPVC Pipes:

Previously:

2005–2010: 45% CAGR

2010–2015: 23% CAGR

2015–2020: 11% CAGR

Projected 2020–2025: ~9–10% CAGR (per Lubrizol)

Real estate recovery is not sufficient.

Pipes demand is led by agriculture (~45%), plumbing (17–18%), and municipal projects. Real estate alone cannot drive broad-based growth.

Even in a bullish scenario (e.g., OPVC scaling from ₹12bn to ₹100bn in 5 years), the overall industry CAGR is capped at ~10–11%.

🔹 Supply: The Real Risk

Supply is outpacing demand, setting the stage for intense competition and margin compression:

Resin Import Dependency

CPVC Resin Overcapacity

India currently imports ~80% of CPVC resin. That is set to change:

Current CPVC usage: ~275,000–300,000 tonnes/year

Expected Domestic Capacity by FY30: > 500,000 tonnes

Reliance:

Phase 1: 11,000 tonnes (FY26)

Phase 2: 300,000 tonnes in 5 years (more than total current usage)

Apical: Expanding from 75,000 to 150,000 tonnes

Result: Product premium will erode

CPVC Resin currently: ₹130/kg

PVC Resin: ₹70/kg

Expected CPVC price decline: to ₹90/kg → Will drag overall pipe realisations

New Entrants + Expanding Old Giants

Welspun is entering OPVC—looking to shift away from DI pipes

Podar Plumbing (ex-Ashirvad promoters) returns post non-compete expiry in 2026—already has land, machinery, and know-how

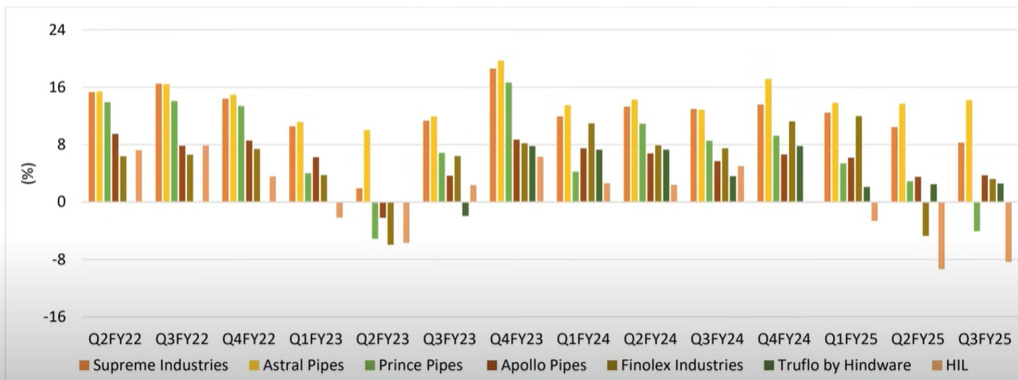

Existing Players: Supreme, Astral, Prince, Apollo growing capacity at 16% CAGR vs 12% demand growth

Market Share vs Margins: The Strategic Dilemma

Supreme Industries:

Highest capacity additions, 30–40% distributor growth

Doubled distributors in Mumbai

Focus: Market share → Accepts discounting, lower margin

Astral:

Conservative capacity growth

Focus: Profitability → Currently enjoying best-ever margins

But future margin pressure seems inevitable even for Astral

China: The Invisible Hand in PVC Pricing

India is heavily dependent on PVC imports, and China’s supply glut is becoming a deflationary force:

India imports 60–65% of PVC resin, China’s share now at 36% (up from <5% five years ago)

China is expected to add 9 million tonnes of new PVC resin capacity over the next 2 years

Chinese domestic demand has been flat for 6 years → Exports surge

What it means:

India gets dumped with cheap resin

Anti-dumping duty expected around July–August 2025, but imports will continue as India remains structurally short

Short-term re-stocking may occur if price stabilises, but won’t solve long-term demand issue

OPVC: Disruptive Tech or Next Price War?

Two kinds of OPVC machinery are creating diverging cost structures:

Expensive Machines: ₹40–50 crore (Molle/Rolepal)—Used by Supreme, Apollo, Welspun

Cheap Machines: ₹6–7 crore (Chinese/Indian)—Used by Astral

OPVC selling price today: ₹300/kg

If tenders go L1 (lowest bid wins), expect prices to fall to ₹100–150/kg

This tech bifurcation may spark a pricing war, especially as lower-cost players underbid and drag down segment margins.

M&A & Consolidation

With rising stress:

Big players are acquiring distressed assets:

Supreme acquired Wavin

Apollo acquired Kisan Moulding + Parvati Pipes

Strategic rationale: Distribution networks, geographic access, product IP (e.g., OPVC rights)

This trend is likely to accelerate as smaller companies fail to compete on costs or margin pressures.

Valuations: High, But Why?

Despite everything:

Pipe stocks trade at rich multiples

But:

PAT CAGR over last 3 years: 0%

EBITDA growth underwhelming

Capital intensity rising (esp. in backward integration)

Stocks may face a de-rating once the market fully absorbs:

Margin dilution

Supply-led competition

Lower RoCE

🪵 Part 2: MDF – At the Bottom, But Structurally Healthier

Current Status: Margin Washout

The MDF sector is currently in a margin trough:

Even large players are struggling to stay above break-even

Many smaller players with low-quality Chinese equipment are operating at losses

This is an expected pain point—big players want to flush out unsustainable capacity and avoid fresh entrants.

Comparison of MDF, Plywood, Particle Board & HDHMR

MDF demand is growing fastest (15–20% CAGR), replacing plywood in many use cases.

Plywood is still dominant in traditional carpentry and premium work but losing share in modular setups.

Particle Board is bottom-end and largely unorganised—used where cost is key.

HDHMR is a premium engineered board gaining popularity in urban kitchens and high-moisture areas.

Demand Still Strong

MDF demand growing at 15–20% CAGR, driven by:

Affordable housing

Organized furniture retail

Shift from plywood to MDF

Capacity Addition Slows

Very few new plants expected in FY26

Only modest additions in FY27

This gives time for demand to catch up and correct the supply glut

Raw Material Easing

Timber costs, which more than doubled in recent years, are cooling off

A 4–5% correction in Q4 is encouraging

With plants now at healthy utilisation levels, companies can focus on pricing discipline and margin recovery

Cyclical Industry Dynamics

MDF is a high capex, low asset-turn business:

₹600 crore investment = ₹600 crore revenue

With current 5% EBITDA margins, RoC is mid-single digits

For sustainable returns, RoC needs to rise to 12–15% → Requires 10–12% EBITDA margins

Outlook: Margins should improve over 2–4 quarters. Medium-term looks promising unless a new wave of irrational capex begins.

🧱 Part 3: Tiles – Saturation and Survival

Demand Flatlining

Domestic tiles demand growing at just 6–8% CAGR over 10 years

Export growth also under pressure due to geopolitical shifts and global slowdown

Morbi’s Impact: Brutal Overcapacity

Morbi (Gujarat) has grown from 250 to 1,000+ units in 10 years

This massive unorganised supply base keeps prices depressed

Many operate with ultra-low cost base, giving them pricing flexibility

Comparison of Tile Types in India

Margin Preservation = Cost Cutting

Branded players (e.g., Kajaria) are:

Reducing advertising spends

Cutting staff costs

Tightening distribution

Result: Short-term margin improvement, but no structural solution unless demand revives

“Tiles may see EPS uptick, but unless demand improves, it’s a sugar high, not a recovery.”

Final Scorecard

Conclusion: Valuations Are Pricing the Past

The building materials sector is no longer a uniform growth story.

Pipes are entering a margin war zone

MDF is past the worst but needs capital discipline

Tiles are structurally challenged due to fragmented supply and flat demand

Investor takeaway:

Valuations are still reflecting past optimism. But the cycle has turned—and it's increasingly a game of survival, not just growth.

If you found this deep-dive valuable, consider subscribing and sharing. Got questions or looking at specific stocks in this space? Hit reply or drop a comment below.

With Love,

Priyank