F) Operating Leverage

Few sectors and companies have huge operating leverage

Gross margins are high and so are fixed costs

There is room to produce more because capacities also exist

When revenues increase, the fixed costs do not go up in the same proportion, leading to a jump in reported profits

Example: ABB India Ltd

From CY17 to CY20, revenue were flattish and Fixed and Employee Cost Remained the same (%)

Sales grew sharply over the CY20 to CY22

Operating leverage kicks in as Expenses & Employee cost rose lower than revenues, leading to EBITDA margins jumping from 5% to 14%

Depreciation and interest costs remained the same, leading to a 6x jump in PAT.

The same got reflected in the sharp jump in the stock price.

Few more examples

Adani Power – Higher capacity utilization and stable fixed costs led to a sharp expansion in margins.

Reliance Industries – Jio and retail businesses scaled rapidly, improving margins with minimal cost additions.

Larsen & Toubro (L&T) – Strong execution of large infrastructure projects led to revenue growth outpacing cost increases.

Zomato – As order volumes surged, fixed costs (like technology and delivery infra) were spread over a larger revenue base, improving margins.

G) Completion of Major Capex

Companies take up capital expenditures from time to time

In some sectors, capacity increase is lumpy, takes time and is a step-up phenomenon

In initial years, the Balance Sheet size jumps (debt also increases) but revenues do not increase as the capacity increase in under implementation

Once the capacity comes on stream and is efficiently utilized, on the same balance Sheet the revenues jump. Leading to higher profits as well as all-return ratios

Operating leverage also comes into play

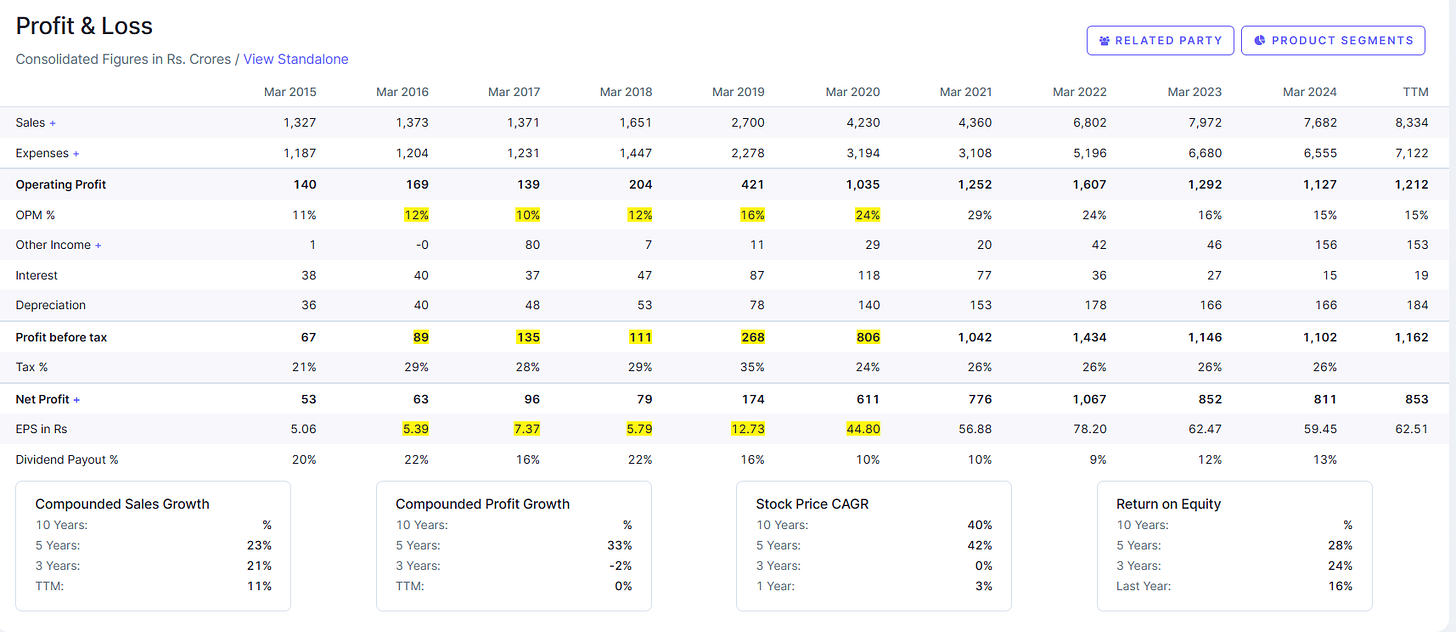

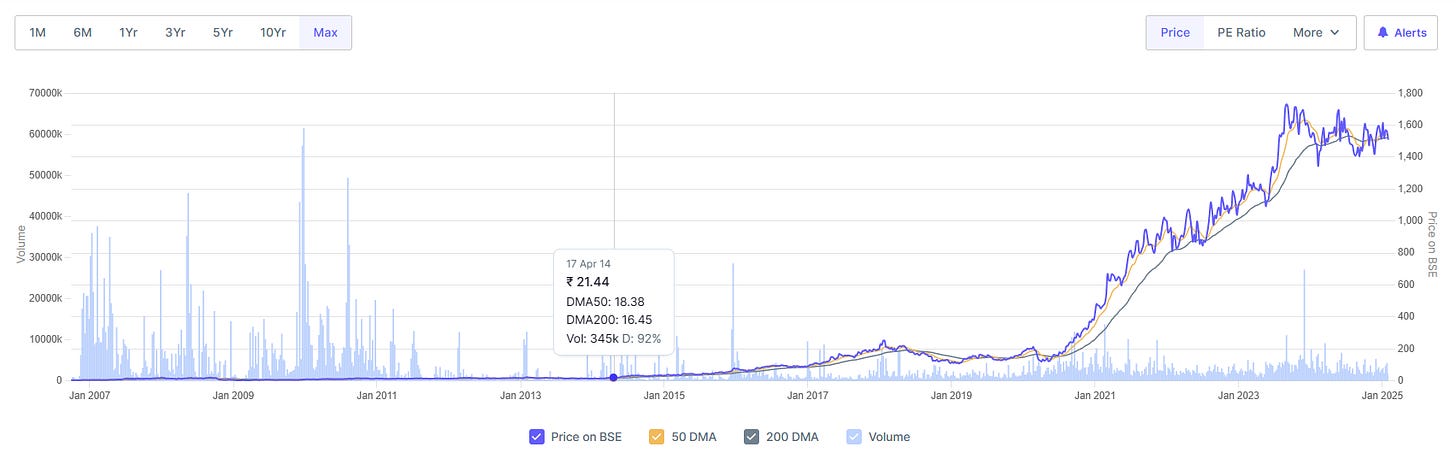

Example: Deepak Nitrite Ltd

The period till FY18 had no growth

It was a boring low growth business

Company undertook a bold capex that tripled its Gross Block

When the capex came on stream, the revenues, profits and scale of the company surged sharply

Stock price jumped 36x over 2016-2024

Few more examples

Reliance Industries (Jio) – Massive telecom Capex led to industry disruption and exponential growth.

Hindalco (Novelis Acquisition) – Global aluminum expansion paid off after initial challenges.

Ultratech Cement – Large-scale cement capacity additions and acquisitions drove long-term growth.

Polycab India – Expanded wire & cable manufacturing capacity, leading to multi-fold revenue growth.

APL Apollo Tubes – Structural steel tube Capex boosted scale and market leadership.

PI Industries – Heavy investment in specialty chemicals drove strong earnings growth.

H) Change of Perception

As humans, we all have past memories and preconceived perceptions

Negative memory is stronger than positive memory

Not so pleasant experience with a company or promoter lingers in our thoughts, leading to a closed mind in re- evaluating companies

Have seen many instances of a change in promoter behavior, move to professionalize management, forward looking next-gen joining management

The performance also improves, but more importantly, there is a sharp swing in perception (P/E)

Example: APL Apollo Tubes Ltd

Company operated in a commodity business

Low operating margins and no moat led to low multiples

Consistency of performance, high growth and branding focus led to the company being treated as a consumer company

High ROEs obviously helped

The stock price jumped 68x over 2014-2024

Few more examples

1. Cera Sanitaryware (Sanitaryware & Faucets)

Earlier: Operated in a commodity-like business with low margins.

Transformation: Focused on branding, premium products, and distribution expansion.

Outcome: Valuation multiples expanded as it was perceived as a premium consumer brand rather than just a manufacturer.

2. Kajaria Ceramics (Tiles & Ceramics)

Earlier: A tile manufacturer operating in a low-margin, commodity-like business.

Transformation: Invested in branding, premium product lines, and better distribution.

Outcome: Became India’s leading tile brand, commanding higher pricing power and better margins.

3. Astral Ltd. (Pipes & Adhesives)

Earlier: A pipes manufacturer in a commoditized market dominated by unorganized players.

Transformation: Strong branding, introduction of CPVC pipes (higher margins), and expansion into adhesives (like Fevicol competitor).

Outcome: Higher ROEs and a transition to a consumer-oriented company with strong brand recall.

4. Page Industries (Jockey India - Innerwear & Athleisure)

Earlier: Innerwear was mostly an unbranded, price-sensitive category.

Transformation: Premiumization with the Jockey brand, strong distribution, and consistent branding efforts.

Outcome: One of the highest consumer company valuations in India with superior margins.

5. Relaxo Footwears (Footwear)

Earlier: Footwear was a fragmented, price-competitive category.

Transformation: Built strong brands like Sparx, Flite, and Bahamas, focusing on affordability and branding.

Outcome: Margin expansion, better investor perception, and higher valuation multiples.

6. Polycab India (Cables & Wires to Consumer Durables)

Earlier: Low-margin cables and wires business.

Transformation: Moved into FMEG (Fast Moving Electrical Goods) like fans, switches, and LED lights under the "Polycab" brand.

Outcome: Became a strong branded player with improving margins and a consumer-centric valuation.

7. Tata Consumer Products (Tea, Coffee, FMCG)

Earlier: Mostly a tea and coffee commodity business (Tata Tea, Tata Coffee).

Transformation: Expanded into branded consumer products like Tata Salt, Tata Sampann, and Tata Soulfull.

Outcome: Higher margins and a re-rating from a commodity player to an FMCG company.

I) Cyclicals in Downturn

Quite a few investors say no to investing in cyclicals

However, returns made in cyclicals outpace most sectors. The only thing is buying time has to be right, as cycles tend to be shorter

The sheer size of the business (in qty) means that a small up move in product prices leads to a big move in reported profits

Integrated manufacturing is the key

Strong companies that survive sector downturn phases with good Balance Sheet end up making disproportionate profits

Returns tend to be also huge though cyclical

Example: Supreme Petrochem Ltd

Realization jumped from Rs 132/kg in 2020 to Rs 185/kg in 2023

Scale of Operations led to disproportionate increase in revenue, Ebitda and PAT

Stock gave 10x return during 2020-2024

J) Cheap by way of Valuations, Lagging Triggers

Kabhi chalta hi nahi hai, no growth, no triggers, some other reasons

Such companies usually trade at low P/E multiples but have decent operations and business track record

Any positive change in the historic parameters leads to a quick and significant rerating.

Many times markets wait for confirmation of changes and that gives the opportunity

Institutional ownership is zero or very low and thus when rerating happens, the momentum tends to be very high

K) New Themes / Trends

Fundamentals are fine but themes are the buzzword every time

Dynamic world and therefore new themes keep on popping up

Difficult for value-conscious players but returns tend to be sharp and high

Works well when one is right but invariably the in-themes lead to many other companies opting for listing in the same space

Example: Housing Theme, EV Theme, Consumption Theme, Renewable Theme, Tourism Theme

Let me know your thoughts! 📢

Much love,

Priyank

Source: Mr Sunil Singhania