A) Change in Management

Management is one of the most important factors that drives corporate performance as also the perception (P/E) of a company

A competent management team is a must; it can be promoter driven or professional management

There have been many instances of change in management leading to a sharp turnaround in a company's performance – loss to profit, faster growth, tough decisions, etc

Improvement in performance also leads to a significant rerating of multiples, leading to possibilities of multi-bagger

Change in management can be – change in ownership, Private Equity takeover, new professional management (CEO)

Example: Tube Investments

The appointment of Mr. Vellayan Subbiah as Managing Director in August 2017 was a turning point, driving strong sales and PAT growth, leading to a stock re-rating.

The 2020 acquisition of CG Power accelerated expansion into new sectors like semiconductors and EVs.

Under new management, from FY18 to FY24, sales grew at a 22% CAGR, while PAT grew at a 49% CAGR. This led to a 57% CAGR increase in stock price, multiplying investors' money 15x.

Few other examples

Tata Motors – Natarajan Chandrasekaran (2017) → EV focus, JLR turnaround → 10x since 2020

Trent Ltd. – Noel Tata (2012) → Expansion of Westside, Zudio → 20x+ in a decade

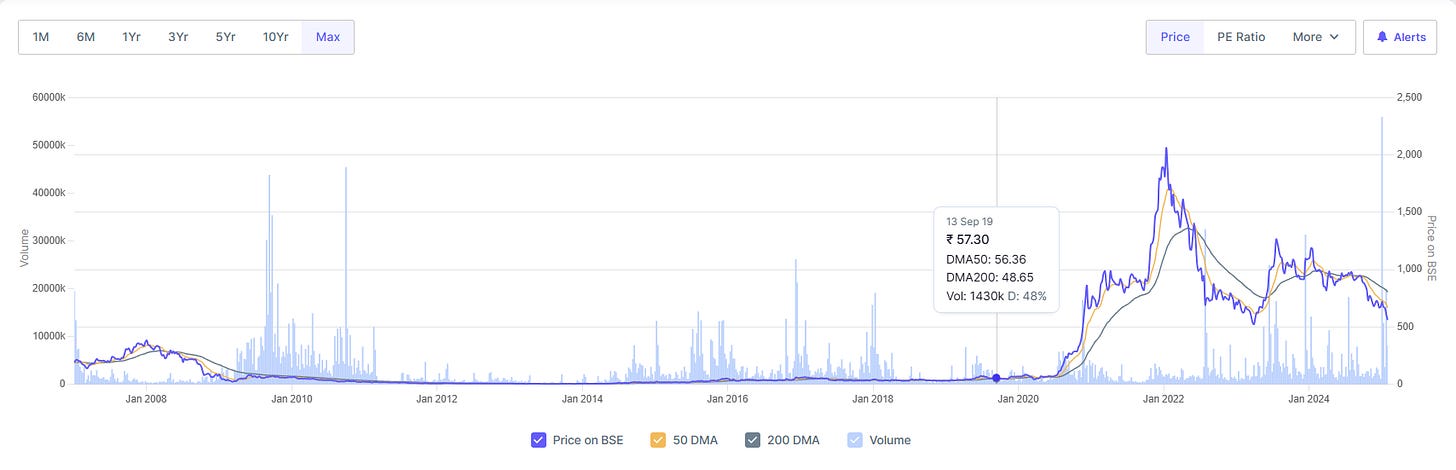

CG Power – Murugappa Group (2020) → Governance reforms, deleveraging → 50x in 4 years

Eicher Motors – Siddhartha Lal (2006) → Royal Enfield revival → 100x+ (2006-2018)

Ashok Leyland – Vinod Dasari (2011) → Cost efficiency, exports → 10x (2011-2018)

JK Cement – New management (2010s) → White cement expansion → 15x in a decade

IDFC First Bank – V. Vaidyanathan (2018) → Retail banking focus → 8x since merger

Jubilant FoodWorks – Pratik Pota (2017) → Digital transformation → 8x (2017-2021)

Shree Cement – H. M. Bangur (2002) → Cost leadership, capacity expansion → 100x+ in 20 years

Dixon Technologies – Sunil Vachani (2010) → Contract manufacturing growth → 40x in a decade

Bajaj Finance – Sanjiv Bajaj (2008) → Retail lending expansion → 150x in 15 years

Pidilite Industries – Bharat Puri (2015) → Brand strengthening → 7x since 2015

Laurus Labs – Dr. Satyanarayana Chava (2016) → API & CDMO expansion → 20x in 7 years

KEI Industries – Anil Gupta (2000s) → Cables & global expansion → 50x in 15 years

B) Consistent Profit Growth

Some companies trade at lower valuation multiples because the market has historically ignored them.

However, if a company consistently delivers growth and profitable growth, the market eventually recognizes its value.

The stock price is driven by two key factors:

a) Earnings Per Share (EPS) and

b) Price-to-Earnings (PE) ratio,

where EPS reflects actual earnings, and PE represents investor perception.

When a company shows steady growth, investors gain confidence in its future potential. This visibility often leads to higher valuation multiples, increasing the stock price.

Over time, the power of compounding also comes into play, further enhancing returns. This combination of consistent earnings growth and improving valuation multiples is a reliable formula for identifying multi-bagger stocks.

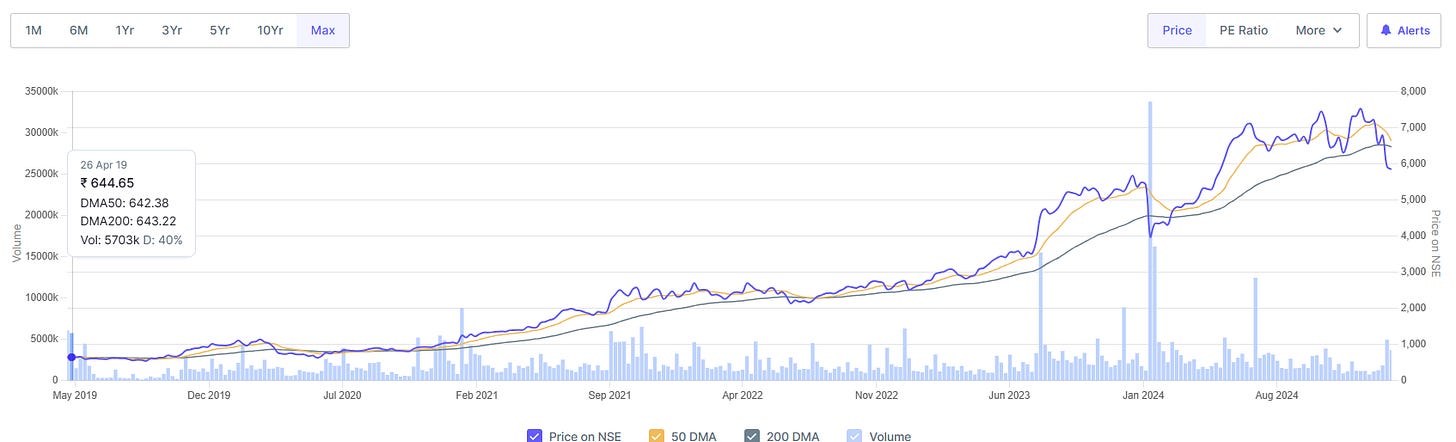

Example: Polycab India Ltd

Polycab’s sales grew at an 18% CAGR from FY19-24, while its PAT consistently increased YoY, growing at 29% during the same period. Additionally, the stock price grew at a ~52% CAGR over FY19-24, multiplying investors' money by 8x (excluding dividends). This growth led to a re-rating of the stock from a 25x P/E to 45x P/E between April 2019 and March 2024. As of February 1, 2025, the stock trades at a 48x TTM P/E.

Few other examples

Bajaj Finance

Titan Company

Avenue Supermarts (DMart)

Marico

Dabur India

Asian Paints

TCS (Tata Consultancy Services)

Hindustan Unilever

Dr. Reddy’s Laboratories

PI Industries

Divi’s Laboratories

UltraTech Cement

C) Split in the Business of the Company

Few companies have multiple unrelated businesses in a single listed entity

A challenging business eats into the profits made by the other good business

Leads to lower reported profits as also dents the multiple

Splitting the company into different entities, each engaged in one business vertical has invariably led to improving valuations and multiples

The reported profits increase and the PE also improves

Example: AGI Greenpac Ltd

Date of Demerger: August 2019

Entities Formed:

AGI Greenpac Ltd: Retained manufacturing, focusing on glass containers, PET bottles, and packaging solutions.

Hindware Home Innovation Ltd (HHIL): Took over consumer product marketing and distribution.

Post-Demerger Developments:

Slump Sale (March 2022): AGI Greenpac transferred its building products division to Hindware Ltd (formerly Brilloca Ltd), retaining some land on lease.

Strategic Focus: AGI Greenpac now specializes in packaging, serving sectors like beverages, food, and pharma.

The demerger streamlined operations, boosting both companies' market positions. AGI Greenpac's stock surged 14x since the demerger.

Few other examples

Bajaj Finance & Bajaj Finserv – 2007-08

Larsen & Toubro (L&T) & L&T Technology Services, L&T Infotech – 2016

Max India & Max Financial Services – 2016

RPG Group - KEC International & CESC – 2017

Tata Chemicals & Tata Consumer Products – 2019

Crompton Greaves & CG Power & Industrial Solutions – 2015

JSW Steel & JSW Energy – 2010

D) Extra Ordinary or One-off Write offs

Few companies see some one-off expenses or write-offs impact their one or few year's profits

Though it is very obvious, markets do look at reported profits, depressing their market cap

Once these one-offs stop, the reported profits see a big jump

Multiples also rise leading to disproportionate returns from the stock

Similar instances can be in the form of a loss-making business being sold off or in the case of banks, loan loss provisions on advances given in earlier years, depressing the current year's profits

Example: Tanla Platforms Ltd

Company had one-off provisions for a few quarters

High w/offs via depreciation led to company reporting losses and depressing stock price

When depreciation normalized, there was a sharp increase in PAT and commensurate surge in stock price

E) Net Loss or Low Net Profit But Cash Profit

Spotting a turn-around early has been a very rewarding analysis

Companies that have faced a rough past but are emerging out of it invariably give very high returns to investors if identified early

First indication of turn-around is a net loss or smaller net profits, but sustainable higher cash profits

Many times this is accompanied by a reduction of debt despite a net loss as there is a significant cash profit and operating cash flow

Eventually the company starts to report good net profits and also benefits from lower interest due to a reduction in debt

Example: Tata Communication

From FY18-20 the company reported losses

However, made significant cash profit

Cash profit were used to pare down debt

Few other examples

Tata Motors

BHEL

Inox Wind Energy

Tejas Networks

Suzlon Energy

RateGain Travel Technologies

GE T&D India

Axis Bank

UPL

Oil and Natural Gas Corporation (ONGC)

Sun Pharmaceutical Industries

Piramal Pharma

Sunteck Realty

Let me know your thoughts! 📢

Much love,

Priyank

Source: Mr Sunil Singhania