The Structural Shift in Global Trade: Trump’s Tariffs and the Future of Markets

Issue #14: ...In Continuation of Issue #12

"Electronics hai Japani,

Gadi hai Germani

Jutta Chappal Kursi mera Chinese

Google, Insta, Whatsapp Americani!"

1. The Changing World Order: U.S. vs. China

The global economic landscape has undergone a structural shift over the past 30-40 years, with China’s rise as a manufacturing powerhouse and America’s industrial decline.

2001: China joined the WTO, leading to a manufacturing boom.

U.S. industrial production flatlined, while consumer spending and GDP kept rising.

There are two charts, both related to the United States:

Chart 1:

X-axis: Global trade (which keeps increasing from 1979 to 2021)

Y-axis: Share of global trade as a % of US GDP

As global trade rises over time, its contribution to the US GDP also increases.

Chart 2:

X-axis: US weighted average tariff on goods and services (in %)

Y-axis: Tariff %

This chart shows how lower tariffs over time correlate with higher trade as a share of GDP.

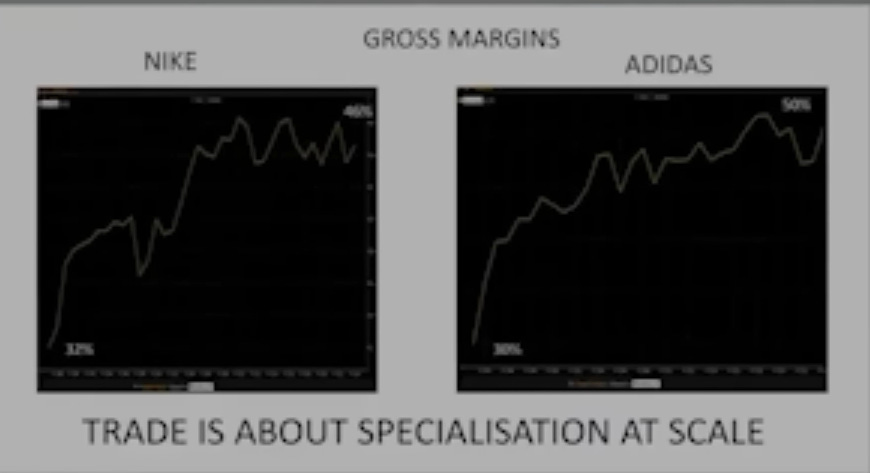

Lets take an example of Nike and Adidas who make most of their products in Asia, especially in Vietnam, China, and Indonesia.

Over the last 30–40 years:

Nike’s gross margin went up from 32% to 46%.

Adidas’s gross margin grew even more, from 30% to 50%.

China now contributes ~17% of global GDP (up from 3% in 1978), while India remains stagnant.

Key Issue:

The U.S. was comfortable outsourcing manufacturing to China (cheaper goods, higher corporate profits).

But now, China is moving up the value chain—competing in high-value sectors (cars, phones, defense, aircraft).

"China is no longer just making t-shirts—they’re making better cars than Tesla at half the price."

2. Trump’s Trade War: Why Now?

The real reason behind Trump’s tariffs is not short-term debt refinancing but a structural battle for economic dominance.

U.S. Problem:

Manufacturing jobs fell from 40% of employment post-WW2 to <10% today.

Labor share of GDP declined, while corporate profits soared.

China is now a peer competitor—with Japan’s innovation, Germany’s manufacturing, and Russia’s defense capabilities.

The above chart tells us a lot about the reason behind the tariff war between US-China.

Dollar’s Role:

The U.S. dollar is the world’s reserve currency, making it structurally expensive.

If the U.S. wants to boost exports, it needs a weaker dollar—but that conflicts with its reserve status.

"The U.S. was fine when it was the only superpower. Now, China is catching up—and America doesn’t like it."

3. The New Trade Reality: Two Possible Paths

Option 1: U.S. vs. China (Irreversible Conflict)

Tariffs escalate, supply chains fragment.

No clear winner—both economies suffer.

Option 2: Coexistence (The Indian Philosophy)

A Sanskrit shloka:

"Om Sahan Vavatu" (May we survive together, grow together, and avoid conflict).

Specialization:

U.S. focuses on digital goods (Google, WhatsApp, Facebook).

China leads in manufacturing (cars, electronics, infrastructure).

India must find its niche—services, IT, or high-value manufacturing.

Taxing Digital Giants:

Google, Facebook, WhatsApp pay little tax in India/Europe.

Solution: Charge ₹50-100/month per user—generates revenue without tariffs.

4. The Hidden Battle: India's ROCE vs China's Marginal Cost War

India and China played fundamentally different games:

1. India's ROCE Obsession (Profit Over Scale)

Tata Motors (JLR): 20% ROCE - premium pricing strategy

Asian Paints: 37% ROCE - won by margin control, not market share

India Avoids "low-margin volume play" that built Chinese dominance

2. China's Marginal Cost Warfare (Scale Over Profit)

BYD: Sells EVs at 4% margins to crush competitors

Hikvision: Flooded global CCTV markets below cost

Furniture: 80% of world's furniture now made in China

3. Who's Adapting Better?

Reliance Jio: Copied China's model - 50M users before profits

Most Indian Manufacturers: Still chasing 20%+ ROCE while losing market share

Stock Implications Today:

Winners: Companies blending both models

Dixon Tech (PLI-driven scale + 29% ROCE)

Sona BLW (EV volumes + 24% ROCE)

Losers: Purely ROCE-focused firms

Bajaj Auto (premium focus hurting in ASEAN markets)

"China built world-beating companies by tolerating 5% ROCE for decade. India's 15% ROCE mandate leaves us uncompetitive in mass manufacturing."

India looks for higher ROCE whereas China looks for Marginal Cost.

5. What Should Investors Do?

Current Market Outlook: High Uncertainty

"Heads I win, tails I survive"—focus on capital preservation.

Avoid large losses—markets are volatile due to trade war risks.

Opportunities Outside the U.S.

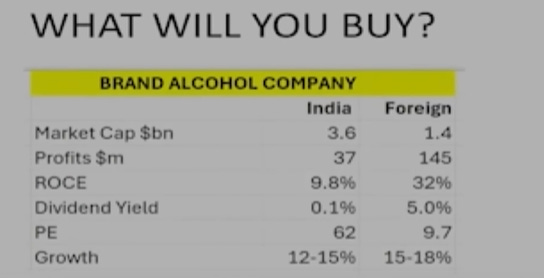

Example: A Philippines-based alcohol company vs. an Indian liquor giant:

Philippines Co.: 5% dividend yield, 32% ROCE, PE of 10x.

India Co.: PE of 62x, ROCE <10%.

Look for undervalued global stocks (Vietnam, Philippines, etc.).

"Indians made money in U.S. stocks. Now, we can make money in emerging markets too."

Final Thought: The Future of Globalization

Trade wars are structural, not temporary.

India must balance:

Local manufacturing (to avoid China dependency).

Digital taxation (to capture value from U.S. tech giants).

Global diversification (invest beyond India).

Conclusion: The world is at a historic turning point. Investors must adapt, survive, and find new opportunities—because the old rules no longer apply.

Subscribe for more deep dives on global markets!