Cement is the backbone of India's infrastructure boom — from homes and highways to factories and bridges.

But what's really happening in the Indian cement sector?

Let’s break down the basics, how the sector operates, and future trends.

Before diving in, check out:

Cement Sector Thematic Report by Motilal Oswal (July 2024): Read here

Market Review of Cement Sector by JSW Cement (Aug 2024): Read here

A detailed webinar by CARE Ratings (Nov 2024) for the latest sector insights: Watch here

A Cement Sector Outlook PDF from Ikigai Asset (Dec 2024): Read here

What is Cement and Why is It So Important?

Cement is a key material used in construction. It's made by heating limestone and clay at extremely high temperatures to create clinker, which is then ground into a fine powder. This powder is mixed with other materials like gypsum and fly ash to form the final product—cement. This simple material is essential in making concrete, which is used in almost every type of construction, from homes to highways.

India is the second-largest cement producer in the world, behind China. The sector plays a vital role in the country’s growth, supporting urban development, residential housing, and large-scale infrastructure projects.

The Size of the Indian Cement Market

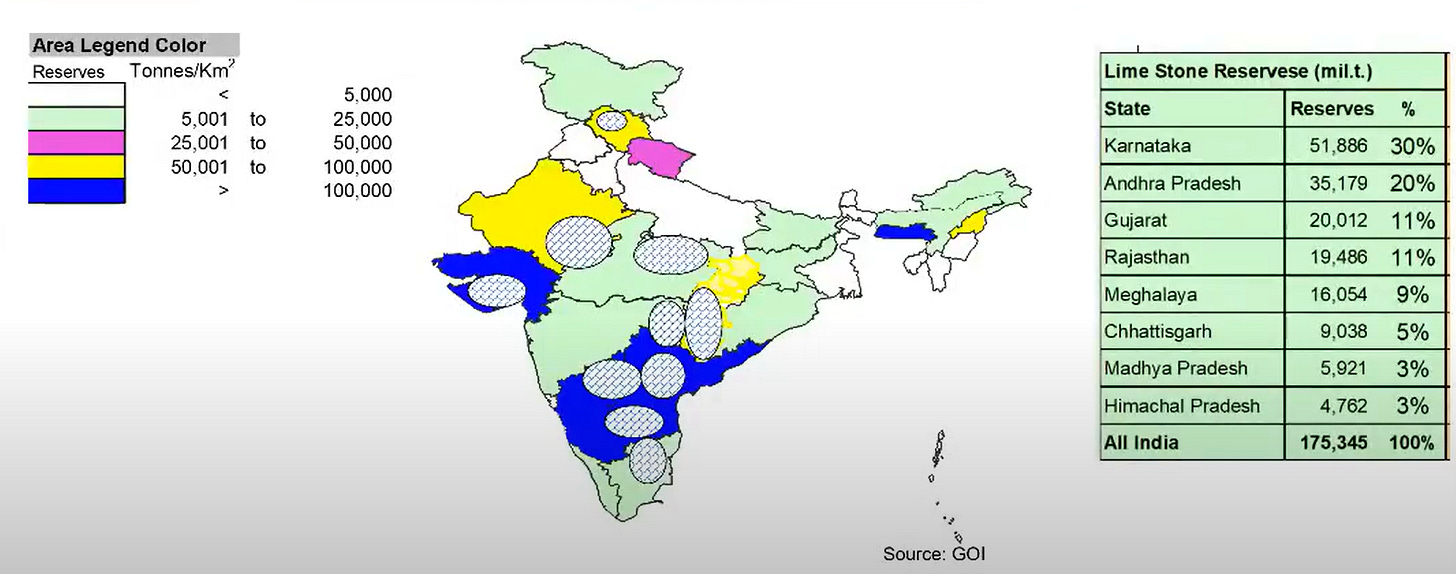

India’s cement industry has made significant strides, reaching a market size of 3.96 billion tonnes in FY23, with projections to grow to 5.99 billion tonnes by 2032, reflecting a CAGR of 4.7% from 2024 to 2032. With abundant limestone reserves spread across the country, the sector offers immense growth potential, making it a key player in India’s infrastructure and construction boom.

Production and Capacity

In FY23, India’s cement production reached 374.55 million tonnes, registering a healthy 6.83% YoY growth. The installed capacity of cement production in India, as of April 2024, stands at 553 MTPA, with a production of 298 MTPA. This capacity is expected to see substantial increases, with plans to add 150-160 million tonnes between FY25 and FY28 to meet growing demand driven by infrastructure and housing needs.

Regional Distribution

India boasts 210 large cement plants, with the highest concentration in Andhra Pradesh, Rajasthan, and Tamil Nadu (77 plants). The regional distribution of cement production capacity is as follows:

South India: 32% of total cement production capacity

North India: 20%

Central India: 13%

West India: 15%

East India: 20%

Cement Exports and Imports

In FY24, India’s cement exports, including clinker and asbestos cement products, were valued at Rs. 5,099 crore (US$ 587.71 million). Meanwhile, cement imports amounted to Rs. 1,442 crore (US$ 166.50 million). This shows that India maintains a strong export presence in the global cement market while keeping imports relatively low.

Demand and Sales Projections

The Indian cement industry is projected to experience an 8% increase in sales by CY25, fueled largely by government infrastructure investments. Despite challenges like reduced sales realizations in CY24 and competitive pressures leading to a 1.5% decline in average cement prices in FY24, the sector remains on a strong growth trajectory. Cement demand in India is expected to grow by 6-7% in FY25, following a solid 7-8% YoY growth in the last quarter of FY24.

Infrastructure Projects Driving Growth

Large-scale infrastructure projects, including the Mumbai-Ahmedabad Bullet Train Corridor, are significantly boosting the cement sector. The project is using about 20,000 cubic meters of cement daily, equivalent to the cement needed for eight 10-story buildings, showcasing the substantial demand generated by such developments.

Outlook

India’s cement industry is on track to reach 450.78 million tonnes of consumption by FY27. To support this demand, the sector plans substantial capacity additions and ongoing expansion. The 150-160 million tonnes capacity increase from FY25 to FY28.

In summary, India’s cement industry is poised for steady growth, underpinned by strong government initiatives, robust domestic demand, and substantial capacity expansions. With key players like UltraTech and Adani enhancing their market positions, the sector is set to continue its upward trajectory in the coming years.

Key Drivers of Cement Demand in India

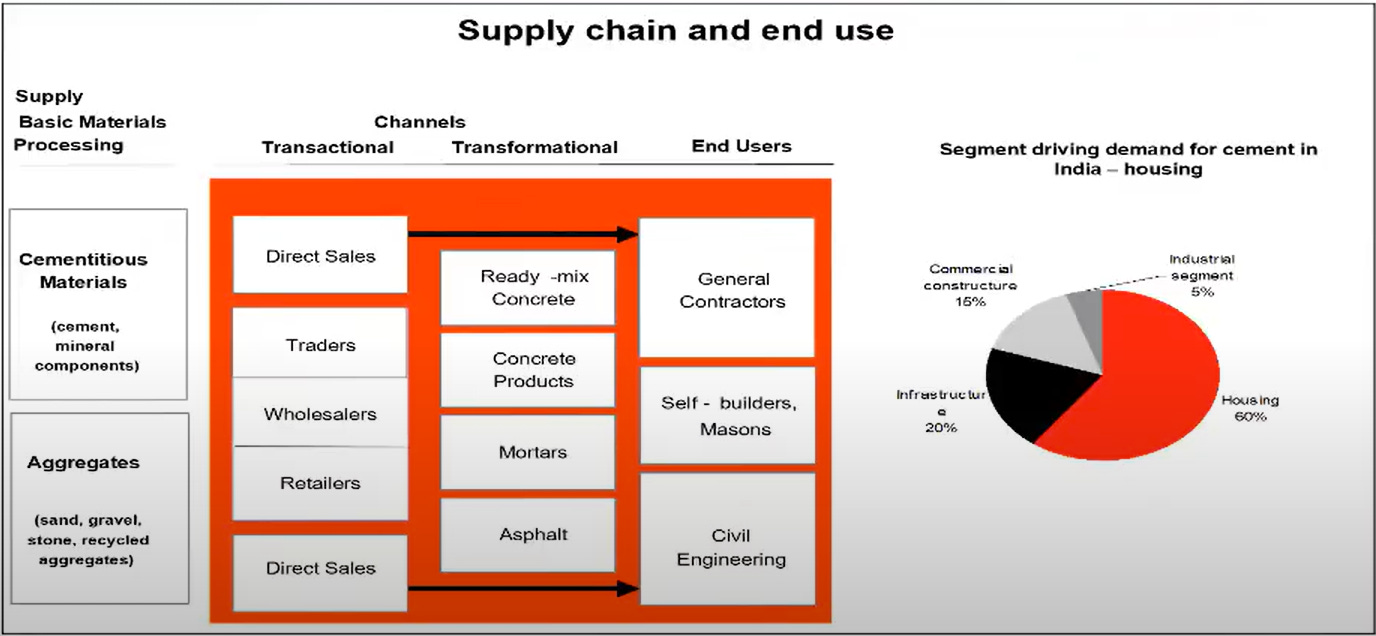

1. Housing Sector

About 60% of cement demand in India comes from the housing sector. With more people moving into cities and the government's push for affordable housing, cement demand in this sector continues to grow.

2. Infrastructure Development

The government is heavily investing in infrastructure. This includes road projects, bridges, and the development of national highways, which make up another 20% of cement demand. The PM Awas Yojana, which aims to build affordable housing for millions of people, is a significant contributor to this growth.

3. Commercial Construction

The remaining 15-20% of cement is used in commercial construction, including office buildings and factories. As the economy grows, more commercial buildings are needed.

The Cement Manufacturing Process: How Does it Work?

The manufacturing process of cement is similar across most companies:

Making Clinker: First, limestone (a type of rock) and clay are heated at extremely high temperatures in a kiln. This creates a material called clinker, which is a semi-finished product.

Grinding: The clinker is then mixed with other materials like gypsum and fly ash and ground into a fine powder—this is the cement we use in construction.

The cement manufacturing process is energy-intensive, meaning companies need a lot of power and fuel to run their plants.

Types of Cement and Concrete

Ordinary Portland Cement (OPC):

Also referred to as grey cement or OPC, it is widely used in ordinary concrete construction.

Composition:

Clinker (95%)

Gypsum (5%)

Portland Pozzolana Cement (PPC):

Also known as fly-ash cement or PPC.

Typical Composition:

Clinker (65–70%)

Gypsum (5%)

Fly-ash (25–35%)

Portland Blast Furnace Cement (PBFC):

Also known as blast furnace cement.

Typical Composition:

Clinker (45–50%)

Gypsum (5%)

Slag (45–50%)

White Cement:

A type of Ordinary Portland Cement. Ingredients include clinker, fuel oil, and iron oxide.

Iron oxide content is kept below 0.4% to ensure whiteness.

Mainly used to enhance the aesthetic value in tiles and flooring.

Cost: Higher than grey cement.

RMC (Ready-Mix Concrete):

Concrete manufactured for direct delivery to construction sites in a freshly mixed, plastic (unhardened) state.

Mixture of Portland cement, water, and aggregates (sand, gravel, or crushed stone).

Consumers: Mostly large builders.

Nature of segment: Highly competitive → Low margins.

Major Costs in Cement Production

Cement manufacturing is costly, and there are three major expenses for companies:

1. Raw Materials (15-20% of total cost)

The main raw material is limestone, and companies often have to lease limestone mines from the government for long periods. However, changes in government laws could raise the cost of obtaining these resources.

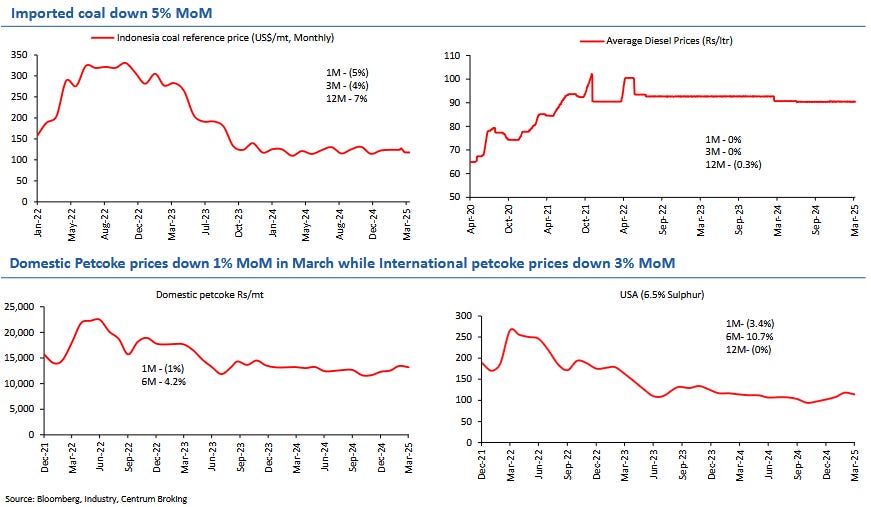

2. Power and Fuel (30-35% of total cost)

Cement production requires a lot of heat, and most companies use coal as a source of energy. This makes power and fuel costs one of the largest expenses in cement manufacturing. Some companies are turning to renewable energy like solar and wind power to cut costs. By FY25, 40-42% of the sector's energy could come from green sources, helping companies save on power costs and reduce their carbon footprint.

3. Logistics and Freight (25-30% of total cost)

Cement is heavy, and transporting it can be expensive. It needs to be moved from the plant to customers, often by rail or truck. Companies try to reduce these costs by locating their plants near raw material sources or customers.

Input Costs Trend

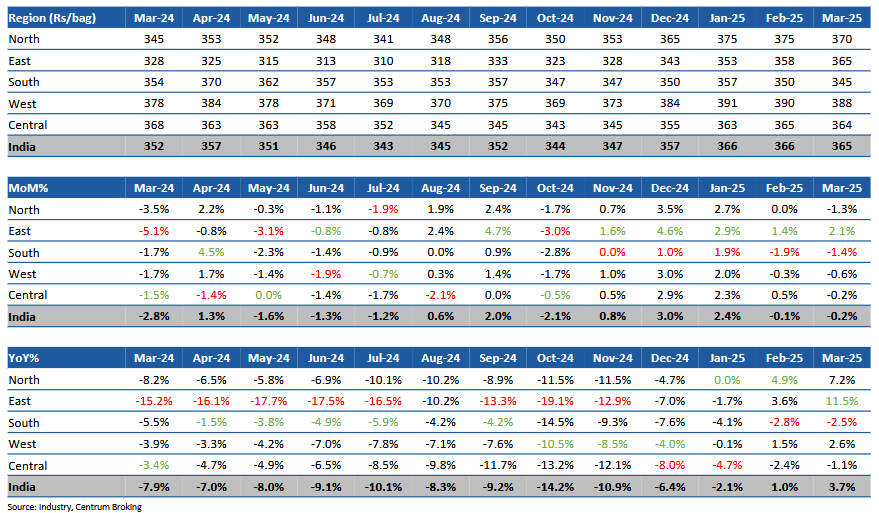

Cement Prices and Demand Trends – March 2025

In March 2025, cement prices across India remained mostly stable, despite the usual end-of-year push by cement companies. However, the South region saw a significant price hike of Rs30-50/bag (announced and implemented towards the end of March 2025) for the first time in a long while, which is expected to stay.

Cement demand remained strong across most regions in March 2025, with slight slowdowns during festivals.

Key players like Nuvoco, Shree Cement, JK Lakshmi, and Birla Corp are likely to benefit from the price hikes in East and North.

Overall, the sector is on track for a solid quarter, likely to see a 10-11% volume growth for 4QFY25.

Industry Economics: What Really Drives Profitability?

As competition heats up and volumes grow, the real edge in the cement sector lies not just in production, but in how efficiently it's done. Here's a sharper look at what separates the winners:

1. EBIDTA per Ton: The Core Metric

While price per bag often grabs headlines, it’s EBIDTA per ton that ultimately defines a cement company's strength. Margins here are heavily influenced by:

Operational efficiency (fuel mix, waste heat recovery)

Brand power and regional pricing strength

Share of blended cement, which brings higher margins despite lower selling prices

Industry insiders expect EBIDTA/ton to rise meaningfully over the next few years as coal costs fall and market consolidation improves pricing discipline.

2. Conversion Factor: Hidden Driver of Cost Efficiency

This metric shows how much material is needed to make one ton of cement. OPC needs less material (~1.05 tons) but uses expensive clinker.

Blended cements like PPC and PSC need more material (1.3–2.0 tons), but they use cheaper waste products like fly ash or slag — which helps lower the overall cost.

3. Pricing Power is Regional & Seasonal

Capacity glut in the South leads to discounting, while supply tightness in the East/North supports better pricing. Seasonally, demand and prices spike post-Diwali through May. These micro-cycles can offer short-term margin boosts — especially for regionally dominant players.

4. Why Capacity Addition ≠ Utilization

Despite plans to push capacity to >700MTPA in next few years, utilization remains around 65–70%. This means actual volume growth depends not just on demand, but also on market reach, distribution depth, and ability to sweat assets better than peers.

What to Watch

EBIDTA/ton trajectory (not just revenue growth)

Blended cement mix (higher-margin product)

Proximity to raw materials & urban centers (saves freight)

Energy transition (renewables adoption = margin buffer)

The Role of Mergers and Acquisitions (M&A) in the Cement Sector

Mergers and acquisitions (M&A) are common in the cement industry. Larger companies acquire smaller ones to:

Expand their market share in new regions.

Gain access to limestone mines (which are crucial for production).

Increase efficiency and reduce costs.

For example, the Adani Group recently acquired Ambuja Cement and Penna Cement, increasing its market presence. The Birla Group (UltraTech Cement) acquired India Cements, adding significant capacity to its portfolio.

M&A activity helps big companies consolidate their position and grow faster than smaller ones, especially in regions like South India, where demand is growing quickly.

The Future of the Indian Cement Sector

The future of the cement industry in India looks promising, but it faces some challenges:

1. Demand is Strong

With continued growth in housing and infrastructure, cement demand is expected to rise by 10-12% annually in the short to medium term.

2. Competition is Increasing

Major players like UltraTech, Ambuja, ACC, and Shree Cement control about 48% of the market share. This is expected to increase to 54% by FY25, meaning there’s still room for larger players to capture more market share.

3. Sustainability Efforts

As India aims for net-zero emissions by 2070, cement companies are increasingly adopting green energy to reduce their carbon footprint. This shift to renewable energy could reduce their power and fuel costs, making the industry more sustainable.

4. Cost Pressures

While renewable energy will help reduce some costs, other challenges remain. For example, the state of Tamil Nadu recently introduced a tax on limestone mining, which could raise the cost of cement production. Companies may pass these costs onto consumers, leading to higher prices in the future.

5. Low Per Capita Consumption

India's per capita cement consumption is still very low compared to countries like China. With an average consumption of 280 kg per person in India, there’s plenty of room for growth. In contrast, China’s per capita consumption is around 1480 kg, which means India could see a similar surge in cement demand over the next few decades.

A Bright Future, But with Challenges

The Indian cement sector is poised for strong growth, driven by the continued demand from housing, infrastructure projects, and commercial construction. While the sector faces challenges like rising raw material costs and power expenses, the shift toward renewable energy and ongoing government initiatives ensure that the industry will continue to grow and evolve.

For investors and stakeholders, the sector presents both opportunities and risks. While competition is fierce and large players are consolidating their positions, the long-term growth story remains strong, especially as the country continues its urbanization journey and infrastructure projects expand.

Thanks for reading!

If you found this breakdown of the Indian cement sector useful, feel free to subscribe and share with others interested in understanding the future of India's economy and infrastructure. Let’s continue to explore more industries shaping India’s growth!

UltraTech Cement: Sneak Peek into the Giant’s Financials

UltraTech Cement stands as the undisputed leader in India’s cement industry, boasting an impressive track record of growth, a strong market presence, and solid financial performance. Here’s a breakdown of the company’s key financial metrics:

Data as of 25th April 2025

Let me know in the comments which cement company you'd like me to dive deeper into! I’ll analyze its financials, market performance, and growth outlook. Drop the name below, and feel free to share why you're interested in that particular company!

Birla Corporation looks the best. Right price to enter and lots of room to grow.

Awesome article, crisp and to the point 👏