Adani Ports: From a Delay at Kandla to Building a Global Logistics Empire

#Issue 23 How one man's frustration with port delays led to the creation of India's most powerful logistics empire.

There’s something fascinating about Adani Ports. What started as a workaround to avoid shipping delays in Gujarat has today become India’s biggest private port operator, running 15 ports across the country and even expanding overseas. And having worked with the Adani Ports team during my time at Adani Enterprises, I’ve seen firsthand how sharp and driven their vision really is.

In FY25, Adani Ports clocked over ₹30,475 crore in revenue—a fivefold jump from just a decade ago. Now, they’re gearing up for their next big leap with a ₹5,000 crore bond raise (their largest ever) and a massive ₹13,000 crore port coming up in Vizhinjam, Kerala.

Let’s break this story down.

How It All Began

Back in the early 1990s, Gautam Adani was importing plastic granules and facing huge delays at Kandla Port. These delays cost him around ₹8–10 crore every year. Instead of just accepting it, he decided to build his own port.

In 1994, he got approval to build a private jetty at Mundra, and by 1998, the first ship had docked. Fast forward to today, Mundra is India’s largest commercial port, and Adani Ports is running a tightly controlled and highly efficient ports empire.

What Does Adani Ports Do?

Adani Ports isn’t just about ports anymore. It’s become a full logistics company with three main business arms:

1. Ports (85% of revenue)

The heart of the business.

15 ports with a combined capacity of 633 MMT.

Most ports are on the West Coast, where India handles 60% of its cargo.

Mundra alone handles 47% of all Adani Ports cargo.

Overseas operations in Israel, Sri Lanka, Tanzania, and recently approved entry into Australia.

Why it stands out:

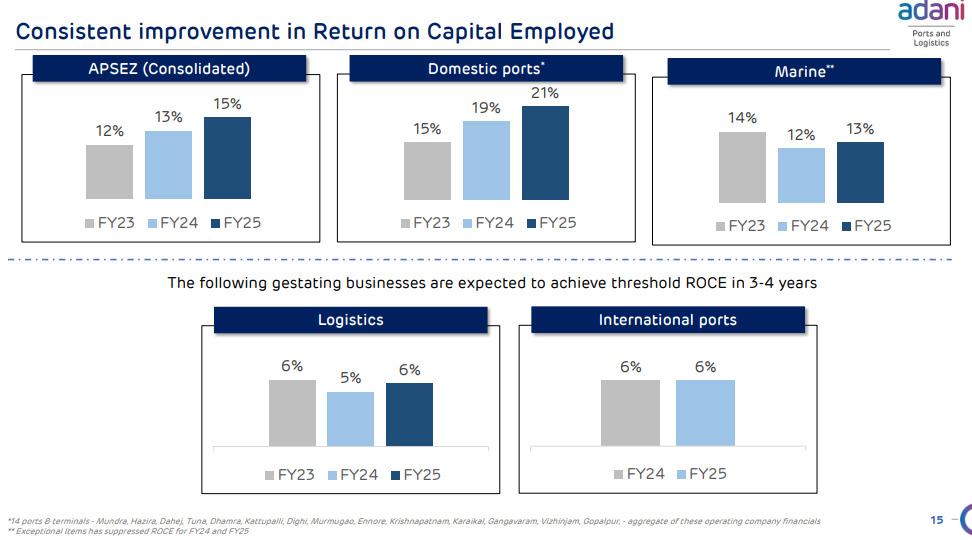

Very high profit margins (~73%), thanks to end-to-end control over operations

Fast turnaround time: 0.7 days vs. ~2 days at most government ports

FY25 ROCE: 21%—a big jump from a few years ago

Having personally visited Mundra Port and worked on projects with the team, I can say the scale and speed are just incredible. Everything from container handling to marine operations runs like a well-oiled machine.

2. Logistics (9% of revenue)

Operates logistics parks, warehouses, and agri storage.

Has 12 multi-modal parks (MMLPs) and is expanding to 20.

FY25 revenue: ₹2,800 crore (up 39% YoY).

Still building this segment out—margins are lower (~22%) for now.

In FY25, they entered digital trucking, building an asset-light model for cargo movement. It’s early days, but this could seriously improve returns going forward.

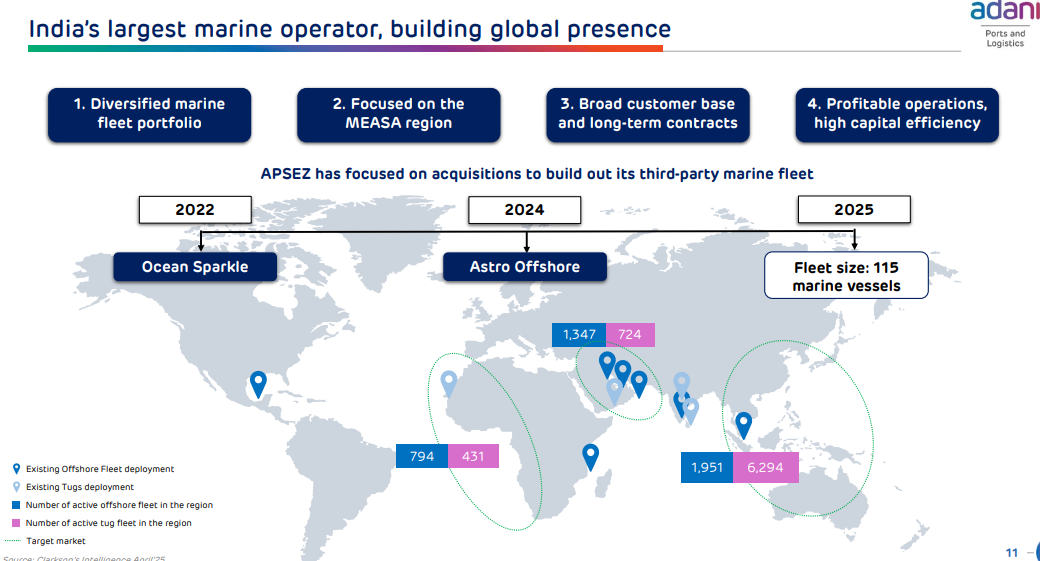

3. Marine Services

Offers tug boats, piloting, marine safety—core port support functions.

Bought Ocean Sparkle (India’s largest marine services firm) in 2022.

Also acquired Astro Offshore (Singapore) in 2024, adding 26 ships.

They now operate 115 vessels, targeting 1,150+ by FY27.

Expect this business to triple revenues to ₹3,300 crore by then.

What’s Next? The Bigger Vision

Adani doesn’t just want to run ports. The goal is to control the entire logistics chain—from a customer’s warehouse in India to their end-customer overseas.

One big move they’re exploring is freight forwarding—a market where global players dominate. It’s asset-light, which means better returns, and gives them a chance to offer one-stop shipping solutions to clients.

FY26 guidance:

Revenue: ₹36,000 crore (~18% growth)

EBITDA: ₹21,000 crore (~16% growth)

Slightly higher operating costs expected, but the business stays solid.

Financials

Adani Ports has improved its debt metrics in recent years:

Net Debt to EBITDA: down from 2.9x (FY20) to 1.9x (FY25)

Debt-to-Equity: dropped from 1.6 to 0.73 in 10 years

However, with ₹13,000 crore going into Vizhinjam and ₹12,000 crore planned for FY26 CAPEX, debt will go up again. Management expects debt/equity to rise to 2.5x in the next 2–3 years. But given their strong cash flows and refinancing comfort, this looks manageable for now.

View

Adani Ports is not just a port operator anymore—it’s fast becoming a global logistics force.

With some of the best margins in the world, a solid grip on operations, and a big-picture mindset, the company looks well-placed for long-term growth.

Of course, it’s still a capital-heavy business, so returns will depend on how smartly they invest and scale. But from what I’ve seen working closely with the team, the intent and execution are both strong.

Let me know if you'd like similar breakdowns of JSW Infra or a broader look at India's logistics sector. And if you’ve ever visited one of Adani’s ports—would love to hear what stood out to you.

Resources for further reading:

Click here for Motilal Oswal’s 4QFY25 result update on Adani Ports

Click here for Adani Ports’ 4QFY25 Investor Presentation

Click here for Motilal Oswal’s Thematic Report on Indian Ports (Feb 2025)

Click here for the Motilal Oswal Initiating Coverage Report on Adani Ports (Oct 2023)

Other Resources:

Click here to watch: All You Need to Know About Ports – A concise explainer on India's port infrastructure, global shipping trends, and why it all matters for trade, logistics, and the economy.

Disclaimer: This post is intended solely for informational and educational purposes. It does not constitute a recommendation to buy, sell, or hold any security. The views expressed are personal and based on publicly available information and past professional experiences. Please consult your financial advisor before making any investment decisions.

Thanks.

Yead for JSW would be great

🚢 Ports: The Hidden Backbone of India’s Economy

Ports may seem like distant industrial outposts, but they’re actually central to how economies move. And in India, they’re the invisible arteries of trade—handling 95% of all trade by volume and 70% by value.

🔍 Why It Matters

If India wants to become a global manufacturing hub and integrate deeper into global supply chains, modern and efficient ports are non-negotiable. Without them, exports slow down, logistics costs rise, and the “Make in India” dream falters.

________________________________________

🕰 A Quick History

India has had a deep maritime legacy—from Harappan dockyards in Lothal to being a hub in the ancient maritime Silk Route. But the modern port system was shaped by British colonialism.

They built major ports in Mumbai, Kolkata, and Chennai under a “service port” model, where the government owned everything: land, berths, cranes, even labour.

But as global trade exploded post-1990s, this model started to choke. Ports needed to be faster, nimbler, and more capital-efficient.

________________________________________

🔄 Enter the Landlord Port Model

To fix this, India transitioned to a “landlord port” system:

• The government owns the land and basic marine infra.

• But private players lease the terminals, invest in cranes, IT, and workers, and run them like businesses.

• They pay the government rent or a revenue share.

The shift was formalised in 2021 through the Major Ports Authorities Act, giving more autonomy and professional governance to major ports.

One success story? JNPT in Mumbai—all container terminals are privately run, while the port authority plays only a supervisory role.

________________________________________

🧩 So, What Is a Port?

A modern port is a mega-machine built into the sea, with:

• Breakwaters to tame waves

• Berths to “park” ships

• Approach channels like sea-highways

• Onshore infra: customs, rail, warehouses, utilities

Inside every port are multiple terminals—each specialised by cargo type.

📦 What Kind of Cargo Do Ports Handle?

Ports aren’t one-size-fits-all. Each cargo type has its own infra and business model:

a) Dry Bulk: This category includes commodities like coal, cement, and ore. The business model typically operates on a "by weight" basis, where charges are calculated based on the total tonnage transported.

b) Liquid Bulk: This involves the shipment of liquids such as crude oil and chemicals. The business model here relies on long-term contracts, offering stability and predictability in volumes and pricing.

c) Containers: Used for transporting a wide range of goods—from iPhones to shoes—container shipping is based on standardized TEUs (Twenty-foot Equivalent Units). This model benefits from scale, efficiency, and global routing flexibility.

d) Break Bulk: Refers to large, non-containerized cargo like machinery and windmills. It requires custom handling, as each item may differ in size and weight, making logistics more complex and labor-intensive.

e) Ro-Ro (Roll-on/Roll-off): Used for transporting cars and trucks, this method allows vehicles to be driven directly on and off ships, ensuring quicker loading/unloading and reducing the need for additional handling equipment.

India still leans heavily on bulk cargo like crude oil and coal. But container cargo is on the rise—mirroring India’s transition to a manufacturing and consumption-led economy.

________________________________________

📍 Geography Shapes Destiny

India’s two coastlines have very different strengths:

• West Coast (Gujarat, Maharashtra): Deep waters, straighter coast, close to Africa & Europe. Gujarat alone handles 40%+ of India’s cargo.

• East Coast (AP, Odisha, TN): Key for mineral exports but faces siltation, cyclone risks, and weaker connectivity.

________________________________________

🚢 India’s Big Problem: Transshipment

India still lacks deep ports that can handle the largest ships. So, containers are first shipped to foreign hubs like Colombo or Singapore, adding time and cost.

To fix this, India is investing in deep-draft transshipment ports like:

• Vizhinjam (Kerala)

• Galathea Bay (Andamans)

The goal: Make India a regional shipping hub, not just a stopover.