☀️ ACME Solar: Betting Big on the Future of Renewable Energy (with Storage)

#Issue 26 Inside the rise of India’s most ambitious clean energy player and how it's powering growth with batteries, hybrid plants, and disciplined execution

India is rapidly transforming its energy landscape, and one company quietly powering this transition is ACME Solar Holdings Ltd. From being a mid-sized solar player a few years ago to emerging as one of India’s most ambitious renewable energy developers with battery storage, ACME is scripting a serious growth story.

In this post, we break down ACME's business model, its transformation after the IPO, and why its bet on hybrid and FDRE might just be in the right place at the right time.

FDRE stands for Firm and Dispatchable Renewable Energy.

🔋 What it means:

FDRE refers to renewable power projects (like solar or wind) that are:

Firm → They provide reliable, consistent power output, not just when the sun shines or wind blows.

Dispatchable → The power can be delivered on demand, especially during peak hours (like evenings), thanks to battery energy storage systems (BESS) or other storage technologies.

So, instead of being intermittent like traditional solar/wind, FDRE projects behave more like conventional thermal or hydro plants — available when the grid needs them.

ACME is shifting a large part of its future pipeline toward FDRE projects to meet India's growing demand for round-the-clock clean power.

🏗️ From Sunlight to Power Plant: ACME’s Business Model

Founded in 2015, ACME is a pure-play renewable Independent Power Producer (IPP). It builds, owns, and operates solar, wind, hybrid, and now increasingly FDRE projects — which combine renewables with battery storage for 24x7 availability.

What makes ACME different?

End-to-End Execution: From acquiring land to constructing solar farms to maintaining them — everything is handled in-house. This gives them tight cost control and operational flexibility.

Long-Term Contracts: Most of its projects sell electricity to government agencies like SECI, NTPC, or SJVN via 25-year power purchase agreements (PPAs). This ensures predictable cash flows.

Battery-Backed Power: ACME is aggressively shifting toward projects that include battery energy storage systems (BESS), enabling reliable round-the-clock power — a massive advantage in a grid that still struggles with supply fluctuations.

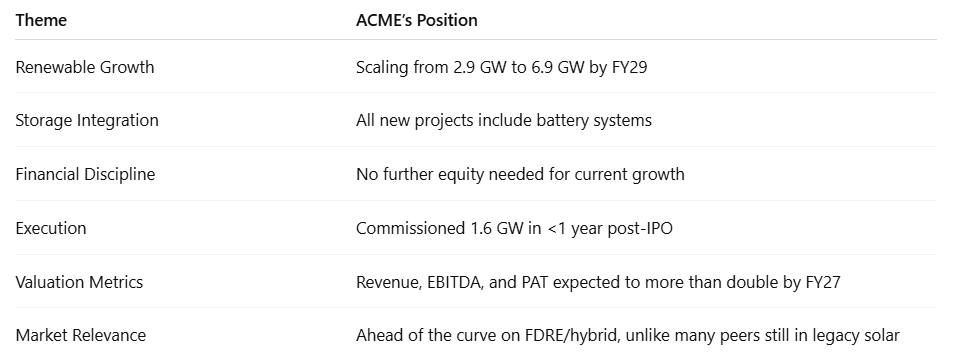

⚡ The Scale-Up Story: Post-IPO Execution Has Been Strong

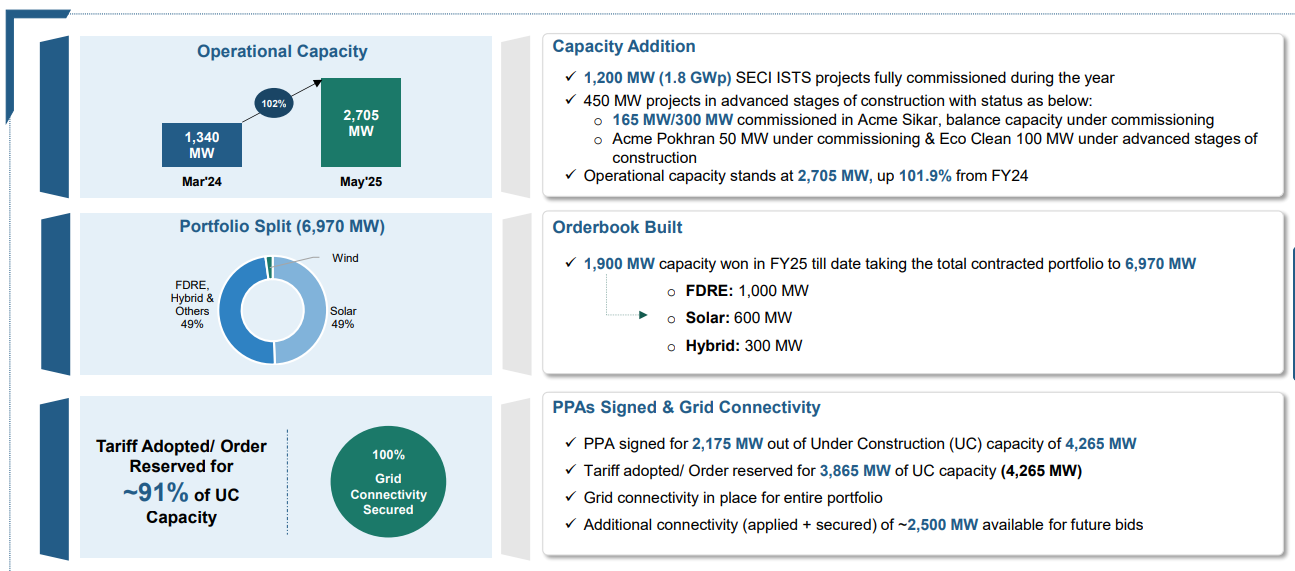

When ACME listed in November 2024, it had ~1,300 MW of operational capacity. Fast forward to mid-2025, and that figure has more than doubled to 2,900 MW. According to management and sector analysts, the company is now targeting the following:

In total, ACME has a 6.97 GW pipeline of renewable projects. That’s a massive number — and how they execute this will define the company’s future.

📦 What’s Inside ACME’s 6.97 GW Portfolio?

As of June 2025, ACME Solar has built a highly diversified renewable energy portfolio across solar, wind, and hybrid technologies. Here’s how it breaks down:

🔋 By Technology

🏗️ By Execution Stage

🗺️ By Geography (Commissioned Projects Only)

🔌 By Buyer (Offtake Split)

🔋 Storage Is the New Solar: Why FDRE Is a Game-Changer

India’s power demand peaks in the evenings. Traditional solar power, which only works when the sun is shining, doesn’t help much with this. Enter FDRE — firm and dispatchable power that comes with battery storage.

Here’s why this matters:

Higher CUF (Capacity Utilization Factor): FDRE projects can run longer hours, raising plant output efficiency from 20–25% (pure solar) to 40–50%.

Better Tariffs: Utilities are willing to pay more for assured supply during peak demand.

Policy Push: From FY26, new tenders require storage as a component. ACME is already ahead of the curve.

All of ACME’s upcoming projects now include battery components, most sourced from Tier-1 Chinese suppliers with 20-year warranties.

📊 Financial Snapshot: Growth Mode Activated

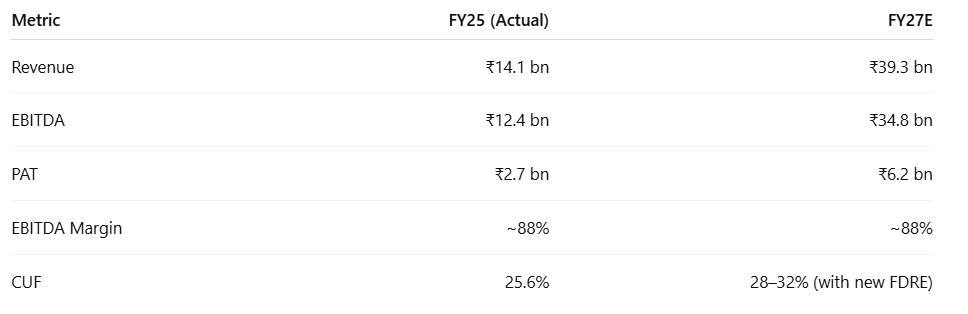

ACME’s earnings are scaling up with its capacity. Here’s a simplified view of how things are moving:

Even with aggressive capex, the company has kept its profit margins high due to in-house execution and low-cost procurement.

🧮 How is FY27 revenue estimated?

ACME is expected to have a total of 4.8 GW of installed capacity by the end of FY27, including 1.9 GW of new projects added during the year. Since these will be commissioned gradually, we use an average operational capacity of ~4.3 GW for the full year.

At an average efficiency (CUF) of 28–32%, this capacity will generate around 10,500–11,000 million units (MUs) of electricity during the year.

Here’s how it’s calculated:

Units generated = Capacity × 24 hours × 365 days × CUF

→ 4,300 MW × 24 × 365 × 28–32%

→ ≈ 10,500–11,000 million units

The average selling price is assumed to be ₹3.3–3.7 per unit, combining:

Long-term PPAs (~70% of portfolio) at ₹2.8–3.2/unit

Higher-paying FDRE and merchant sales (~30%) at ₹3.8–4.5/unit

So, multiplying generation with tariff gives an estimated revenue of ~₹39.3 bn for FY27.

💸 Deleveraging In Progress, Capex Fully Funded

ACME used its IPO proceeds wisely:

Raised ₹2,395 Cr (fresh issue)

Repaid over ₹2,000 Cr of debt

Strengthened balance sheet and liquidity (₹2,900 Cr in cash at FY25-end)

The company has no need to raise more equity for the current project pipeline — a big relief for shareholders concerned about dilution.

It still has to borrow for project capex (which is normal for infra businesses), but it has secured project-specific financing at competitive rates (~8.8%).

🧠 Strategy: Conservative Bidding, Aggressive Execution

ACME isn’t chasing headlines. It’s avoiding ultra-low tariff bidding and instead focusing on:

Selective PPAs with decent tariffs

Merchant market sales (e.g., Sikar plant selling power at ₹3.1/unit until PPA is signed)

Hybrid & FDRE-focused projects where margins are higher and supply is more valuable

This approach reflects capital discipline and a focus on long-term profitability over short-term growth.

📉 Risks to Watch

Every growth story has its challenges. For ACME, the key ones are:

PPA Signing Delays: Some projects are still awaiting formal contracts.

Execution Risk: 1.9 GW is targeted for FY27 — any delay impacts cash flow.

High Net Debt/EBITDA: Expected to peak in FY27 before improving post commissioning.

Policy Shifts: Import restrictions on Chinese battery cells from June 2025 (ALCM policy) may increase future capex for new bids.

🟢 Outlook: Positioned for the Next Decade

With India's push toward 500 GW of non-fossil capacity by 2030, and policy emphasis shifting toward round-the-clock renewable power, ACME is in a sweet spot.

It’s one of the few listed players in India building out a storage-led green power platform at scale — something the market will increasingly value as energy security, reliability, and climate goals converge.

🧾 Summary

If you're looking to understand the future of renewables in India, ACME Solar is not just a solar company anymore — it’s becoming a platform for firm, reliable, green power. And in the fast-changing world of energy, that’s a bet worth tracking.

📄 Click here to read the full FY25 Investor Presentation by ACME Solar

Disclaimer: This post is for informational purposes only and does not constitute investment advice or a recommendation to buy/sell/hold any security.